Summary

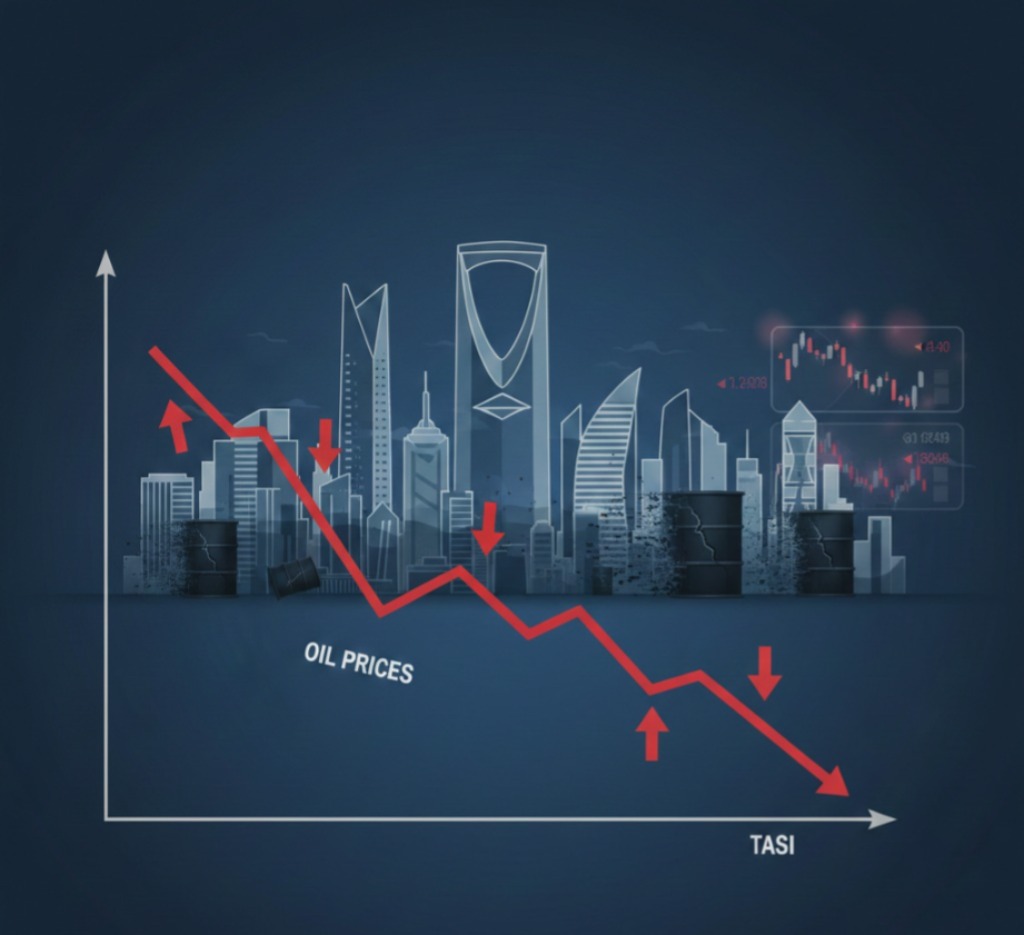

The Saudi Exchange's main index (TASI) closed down by 1.16%, losing 126 points to settle at 10,818 points, in a session marked by profit-taking after a consecutive run of five days of gains.

Today's decline in the TASI index represents a healthy technical correction following a strong upward wave. This indicates the movement was driven by investors' desire to realize profits rather than a negative shift in fundamental economic factors. The impact is primarily liquidity driven and general to the market. In the short term, horizontal volatility may continue, offering opportunities for speculators to enter stocks at support levels. In the medium term, the overall market trend remains positive, supported by strong growth forecasts for 2026.

🎯 What Should Individual Investors Do?

| Speculators | Short-term speculation on selected stocks after the decline. |

| Medium-Term | Hold; consider increasing positions at strong support levels. |

| Long-Term | Hold blue-chip stocks and remain unaffected by daily fluctuations. |