ملخص

جلسة اليوم تؤكد استمرار انتعاش السوق السعودي، مع أداء قوي في بعض الأسهم الثقيلة والقطاعية، بينما لا يزال التركيز على السيولة الانتقائية يدعم الارتفاعات في القطاعات الأساسية، وسط ترقّب المستثمرين لعوامل قد تدعم الاتجاه الصاعد الأوسع.

📊 التحليل الاستثماري

أداء جلسة اليوم يعكس استمرار الزخم الصعودي للسوق السعودي بعد عدة جلسات قوية في الأسبوعين الماضيين، حيث تمتد المكاسب من مستويات الدعم إلى مستويات أعلى مستفيدة من توجهات إيجابية في المعنويات العامة وعودة السيولة لأسهم القيادية.

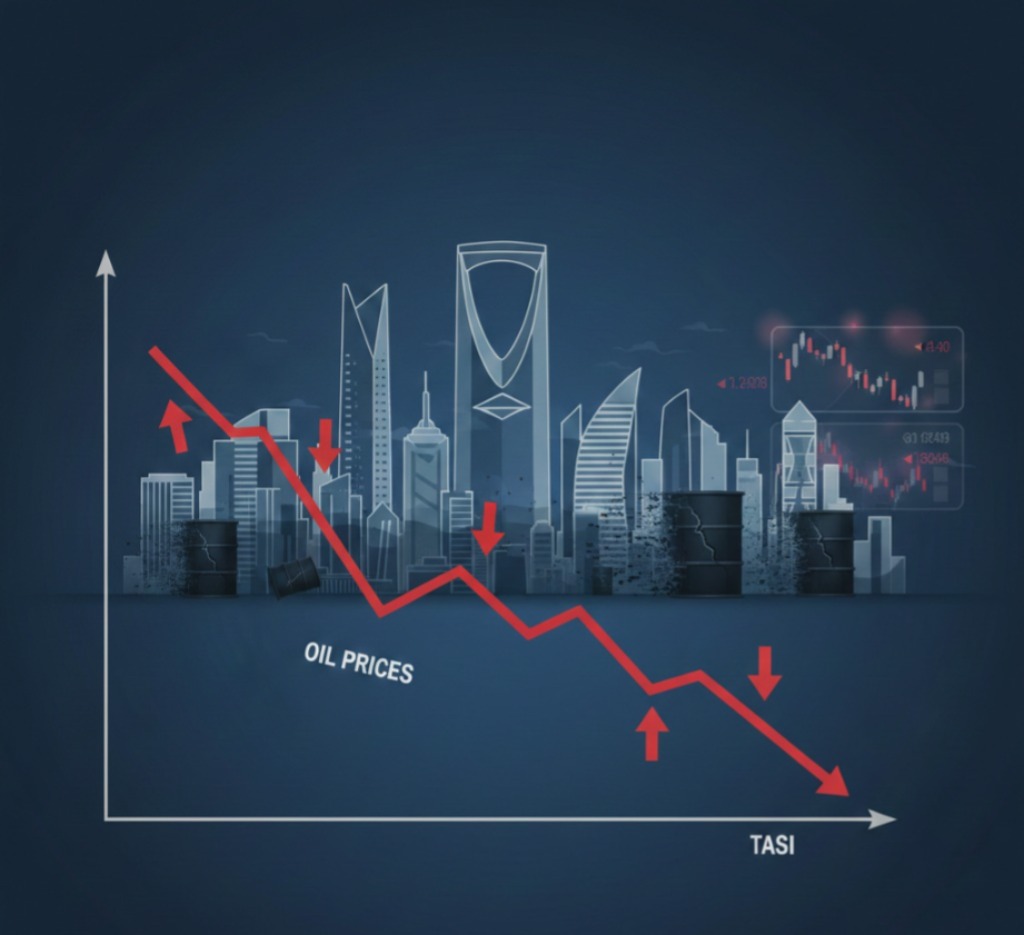

الارتفاعات في تاسي واستمرار التداولات عند مستويات أعلى تدعم فكرة أن السوق بدأ يتجاوز نطاق الحذر في بداية يناير، خاصة مع تجاوب القطاعات القيادية وزيادة الاهتمام العام.

لكن يبقى التساؤل حول ما إذا كانت السيولة الحالية ستتوسع إلى قطاعات أوسع، أم أن السوق سيبقى في نطاقات تقييم أعلى قبل تأكيد اتجاه صاعد ثابت.

🎯ماذا يفعل المستثمرون الأفراد؟

المضاربون: التركيز على الأسهم القيادية التي تُظهر إشارات حجم وتماسك سعري.

متوسطي الأجل: راقب استمرار الارتفاعات والانتشار في السيولة قبل توسيع المراكز.

طويلي الأجل: حافظ على الاستراتيجية الأساسية مع مراقبة أي دلائل دعم من البيانات الاقتصادية.