ملخص

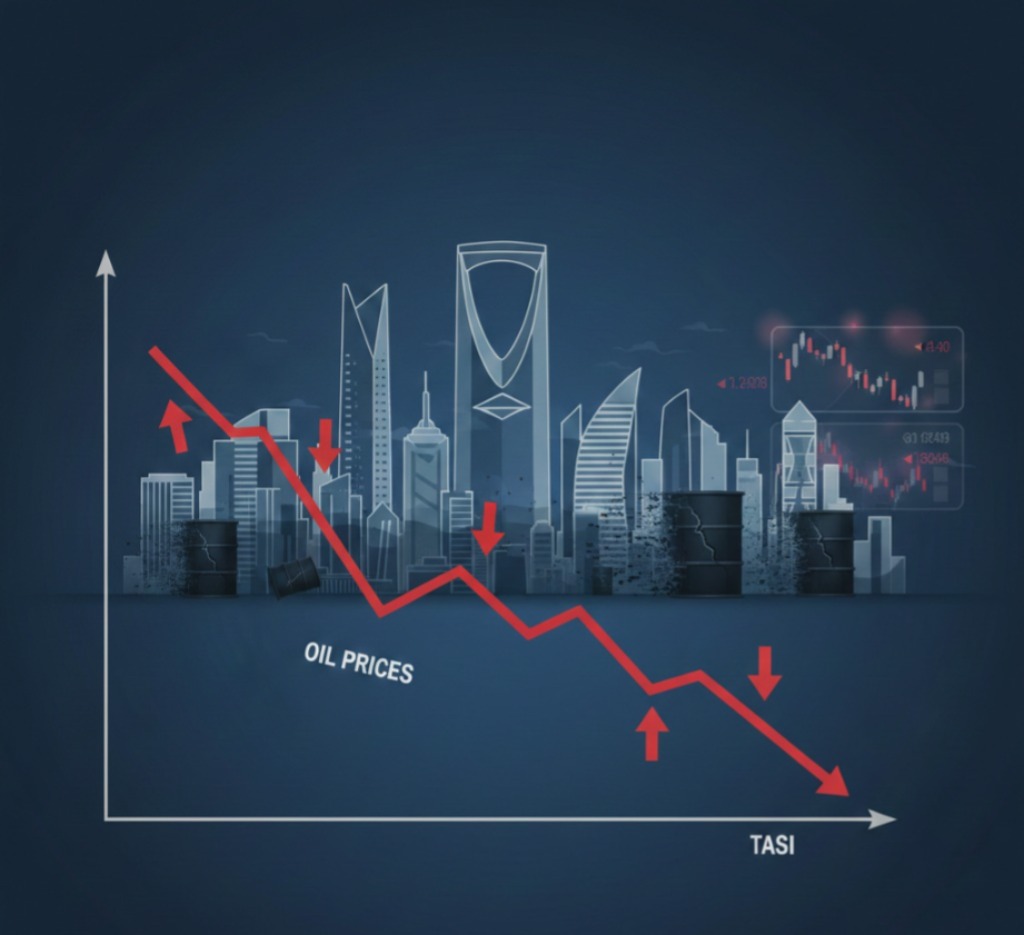

ارتفعت أسواق الخليج بقيادة السوق السعودي بعد صعود أسعار النفط، مما عزّز معنويات المستثمرين وأدى إلى صعود مؤشر تاسي بنسبة نحو 1.3% مدعومًا بارتفاع أسهم الطاقة والمواد والقطاع الصحي، مع بروز أداء قوي لأسهم مثل أرامكو وسابك، في أولى جلسات الأسبوع.

📊 التحليل الاستثماري

جلستنا اليوم تعكس تحسن المزاج الاستثماري في السوق السعودي بعد تراجع الضغط النسبي قبل نهاية الأسبوع الماضي، مدفوعًا بتحسن أسعار النفط الذي يعتبر محفزًا مهمًا للأسواق الخليجية عمومًا — وخصوصًا لأسهم الطاقة والمواد. هذا الصعود لا يزال مرتبطًا ببيئة خارجية إيجابية نسبيًا لكنه ليس اتجاهًا قويًا ثابتًا ما لم يتبعه ارتفاع في السيولة أو أخبار تشغيلية/مالية للشركات.

الأداء الإيجابي اليوم يشير إلى:

رغبة المستثمرين في إعادة التوازن بعد جلسات سابقة متقلبة

تفاعل إيجابي مع الأخبار العالمية (أسعار النفط والسيولة)

تركيز على الأسهم القيادية ذات الأساسيات الأقوى

لكن السوق ما زال في نطاق تقييم حذر، وما زالت السيولة المحلية مفتاحًا أساسيًا لأي توسع حاد في الاتجاه الصعودي.

🎯 ماذا يفعل المستثمرون الأفراد؟

المضاربون: ركّز على الأسهم القيادية التي استجابت للصعود اليوم مع مراقبة مستويات المقاومة والدعم.

متوسطي الأجل: احتفظ بقائمة مراقبة القطاعات التي شهدت ارتفاعات قوية مع تأكيدات في السيولة.

طويلي الأجل: لا تغيّر الاستراتيجية الأساسية — الأخبار الخارجية دعمت معنويات السوق، لكن الأساسيات تستحق متابعة أعمق.