ملخص

شهدت جلسة اليوم تباينًا في أداء القطاعات، حيث أظهرت بعض الأسهم التشغيلية تماسكًا، مقابل تحركات محدودة في قطاعات أخرى.

📊 التحليل الاستثماري

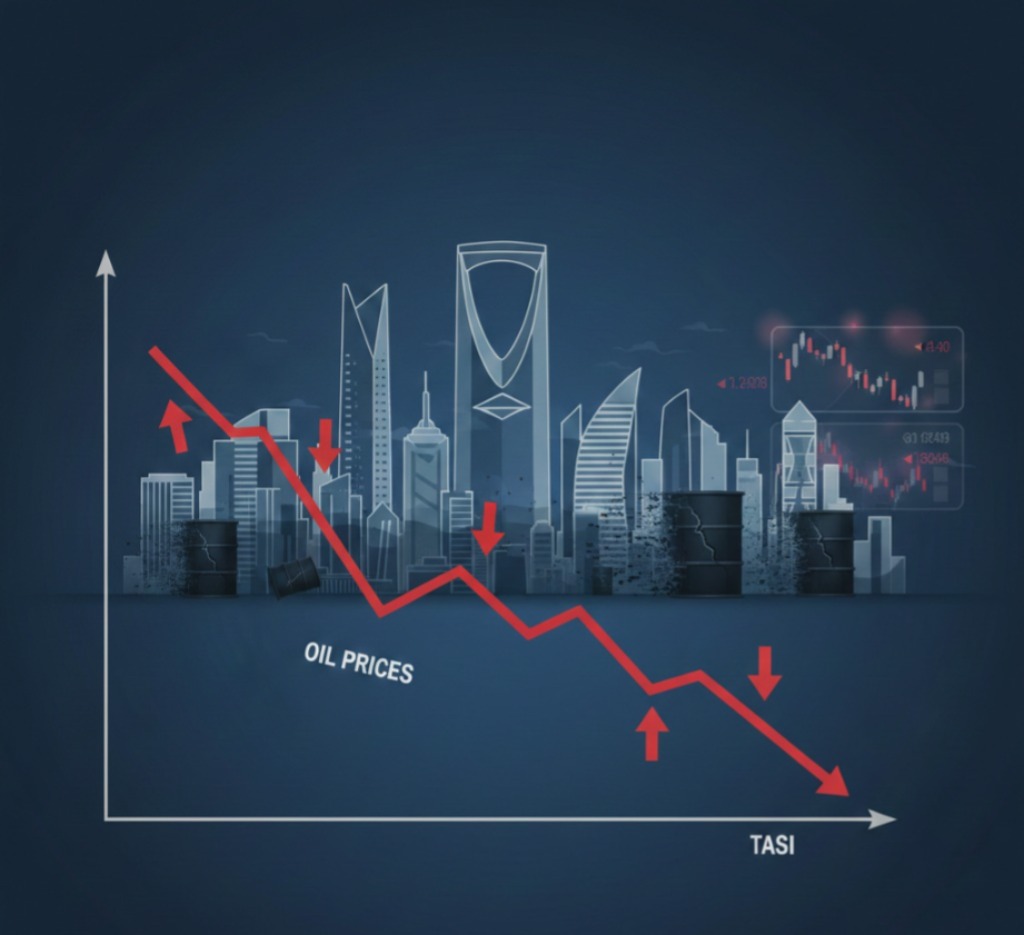

التباين القطاعي اليوم يؤكد أن السوق السعودي لا يتحرك باتجاه واحد، بل وفق قراءة انتقائية للأسهم والقطاعات. تماسك بعض الأسهم التشغيلية يعكس ثقة نسبية في أساسياتها، خصوصًا الشركات التي تعتمد على نشاط تشغيلي واضح بعيدًا عن التقلبات الموسمية أو الأخبار السريعة.

في المقابل، تحركات القطاعات الأخرى بقيت محدودة نتيجة:

غياب محفزات تشغيلية جديدة

ضعف السيولة العامة

تركيز المستثمرين على الأسهم الأكثر وضوحًا من حيث الرؤية

هذا المشهد عادةً يظهر في مراحل التقييم والانتظار، حيث يعيد المستثمرون ترتيب المحافظ بدل الدخول في موجات شراء واسعة. استمرار هذا النمط يعني أن السوق قد يبقى عرضيًا إلى أن يظهر محفز يدفع السيولة للانتشار بين القطاعات.

🎯 ماذا يفعل المستثمرون الأفراد؟

المضاربون: التركيز على الأسهم التشغيلية المتماسكة فقط وتجنب القطاعات الراكدة.

متوسطي الأجل: مراقبة القطاعات التي تحافظ على استقرار سعري متواصل.

طويلي الأجل: التباين الحالي لا يغير الصورة الأساسية طالما أساسيات الشركات مستقرة.