Summary

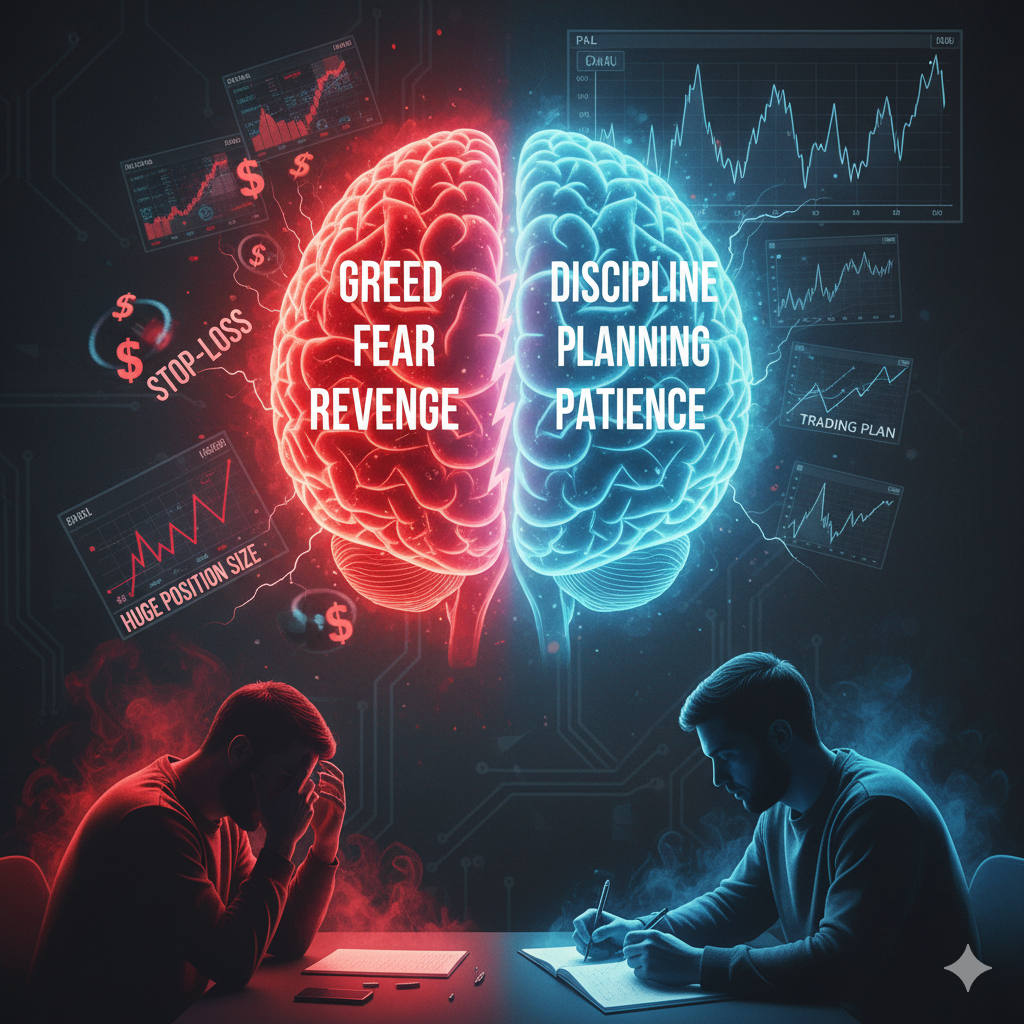

Why do most traders lose? The psychological traps no one mentions.

Most traders enter the market with dreams of getting rich quick, but statistics show that more than 80% lose money within the first year. The reason? Not a lack of tools or analysis, but psychology.

🔹 The most important psychological traps:

Greed: Entering trades larger than the account size, with the goal of quickly multiplying profits.

Fear: Hesitating when a clear signal appears, or exiting profitable trades prematurely.

Market revenge: After a loss, the trader seeks to immediately make up for it with random trades.

Ignoring the plan: Entering based on "feeling" rather than adhering to a written plan.

🔹 How to avoid it?

Write a clear trading plan (targets, stop loss, position size).

Don't monitor your profits/losses moment by moment; focus on the quality of your decisions.

Remember: The market doesn't know you or care about you. Don't try to prove anything to it.

🔹 Bottom line: The difference between professionals and amateurs isn't in indicators, but in controlling emotions. Those who control themselves control their money.