Summary

One-line reflection : If you learn to watch price honestly, you learn the market before you pay for the lesson.

At the start, Jessie works as a quotation-board boy, rapidly posting prices inside a brokerage office. The job looks mechanical—numbers coming in fast, written even faster—but the real edge comes from observation.

He notices that price movement isn’t “random noise” the way most people assume; it has rhythm, repetition, and behavioral fingerprints. That’s where the first foundational principle is born:

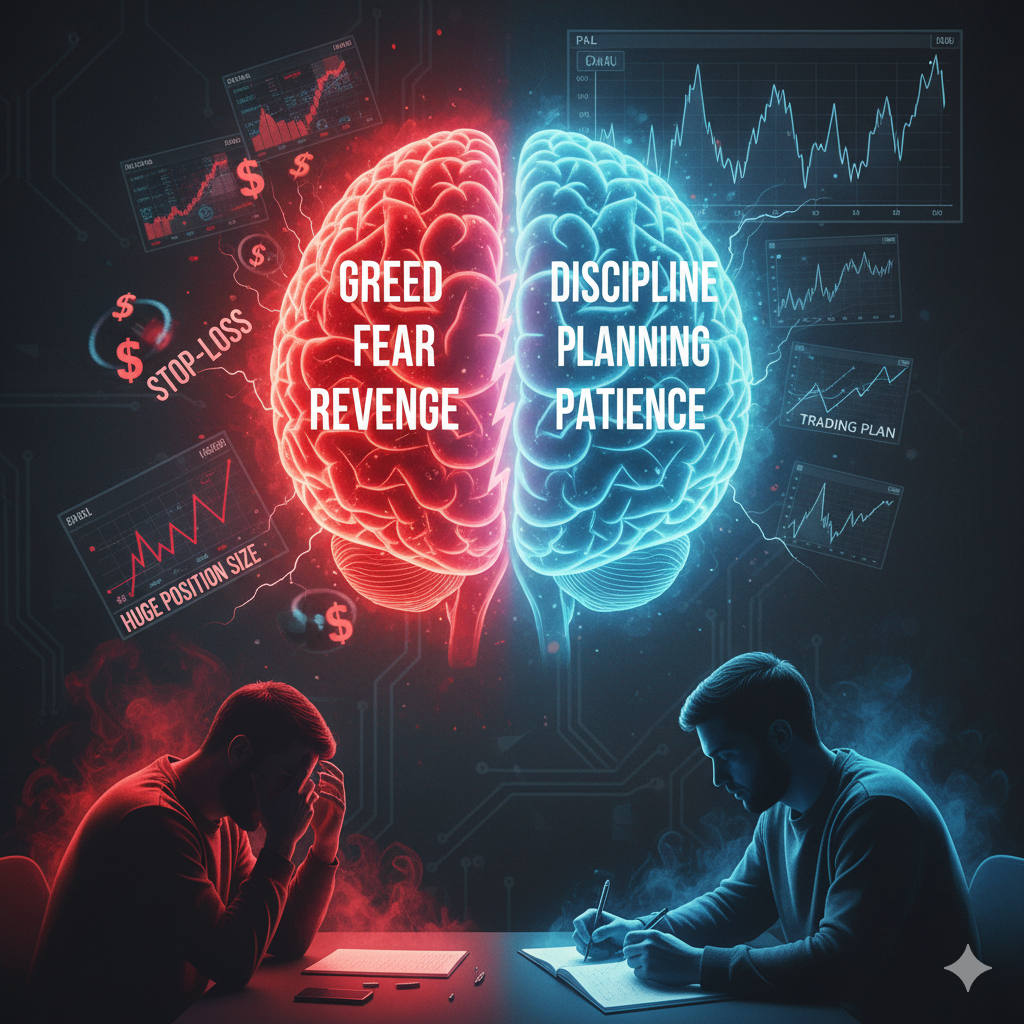

Markets don’t reward intelligence alone; they reward disciplined respect for facts.

Investor Lessons :

- Your edge is not “information” (everyone sees price). Your edge is interpretation + execution discipline.

- Before trading your money, trade your process: watch, log, test, then act.

- The right start isn’t a “buy signal.” The right start is training your eye to spot normal vs abnormal behavior.