ملخص

2025 كان “سنة ضغط” على تاسي لأن السوق انضغط من أكثر من محور في نفس الوقت، وليس بسبب عامل واحد مثل النفط فقط. المؤشر أنهى السنة عند 10,491 نقطة مقابل 12,037 بنهاية 2024 (هبوط سنوي يقارب -12.8%)، ضمن أضعف الأعوام خلال نحو عقد.

لماذا كان 2025 “سنة ضغط” على #تاسي؟

خلّنا نكون واقعيين: 2025 ما كان “سوء حظ”… كان سنة انضغط فيها السوق من أكثر من اتجاه في نفس الوقت.

نهاية السنة أعطتنا رقمًا واضحًا: تاسي أغلق 31 ديسمبر 2025 عند 10,491 نقطة مقابل 12,037 نقطة بنهاية 2024 — يعني هبوط سنوي يقارب -12.8%.

وبلغة الأسواق: هذا كان واحدًا من أضعف الأعوام خلال عقد تقريبًا، مع حديث عن أنه أكبر هبوط سنوي منذ 2015 وفق تقارير متابعة السوق خلال 2025.

“القصة” في جملة واحدة

السوق ما انهار لأن المستثمرين “كرهوا الأسهم”… بل لأن تكلفة المال كانت مرتفعة، السيولة كانت خفيفة، والأرباح/التقييمات ما ساعدت— وفوق هذا كله العالم كان يسحب السيولة لأسواق أخرى.

1) أهم العوامل التي دفعت 2025 ليكون الأسوأ في نحو 10 سنوات

أولًا: تكلفة المال (الفائدة) كانت قاتلة للشهية

عندما تبقى الفائدة مرتفعة فترة طويلة، يحصل شيء بسيط لكنه مؤلم:

البديل الآمن (ودائع/صكوك/أدوات دين) يصبح منافسًا شرسًا للأسهم.

هنا المستثمر الفرد — خصوصًا المحافظ المتحفظة — يبدأ يوازن: “ليش آخذ مخاطرة سهم إذا العائد الآمن صار جذّاب؟”

وهذا الضغط يتضاعف في أسواق مرتبطة بسياسة الدولار مثل الخليج، لأن الحساسية تجاه تحركات الفيدرالي تكون أعلى.

ثانيًا: السيولة الضعيفة = أي بيع يتحول لجرح أعمق

في سوق “خفيف سيولة”، البائع لا يجد دائمًا “مشتري مؤسسي” يمتص الكميات بسهولة.

وهنا ترى الهبوط يكبر بسرعة لأن قوة الشراء ضعيفة. والنتيجة: شهر مثل نوفمبر 2025 شهد ضربة قوية (-9.1%) وإغلاق عند 10,591 مقارنةً بـ 11,656 في أكتوبر.

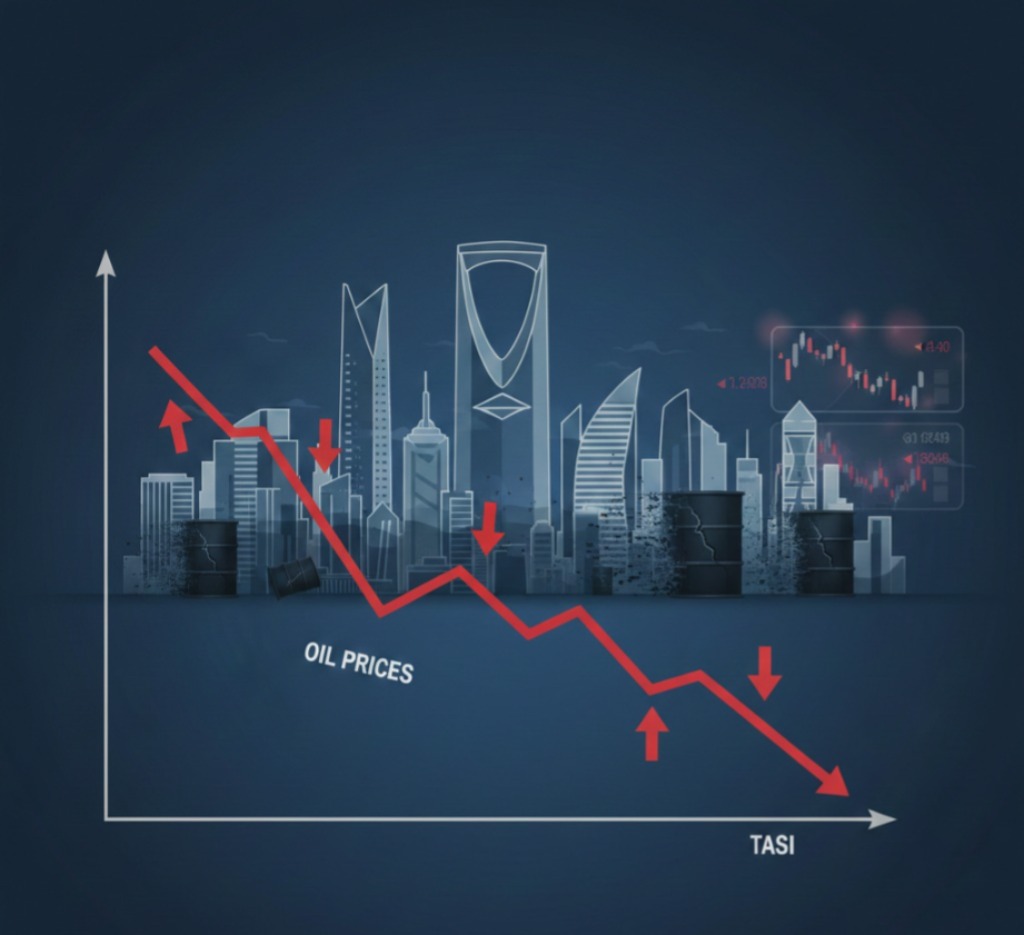

ثالثًا: النفط لم يعد وحده “القائد” لكنه ما زال يغيّر المزاج

النفط في 2025 واجه ضغطًا واضحًا؛ تقارير رويترز تشير إلى أن النفط كان متجهًا لهبوط سنوي يتجاوز 15%.

حتى لو الاقتصاد السعودي أكثر تنوعًا اليوم، مزاج المستثمرين في المنطقة لا يزال يتأثر بالنفط— خصوصًا عندما يقترن ذلك بحديث عن فائض معروض وتباطؤ طلب عالمي.

رابعًا: أرباح الشركات القيادية والتوقعات (خصوصًا في القطاعات الثقيلة)

المؤشر ثقيل الوزن في شركات كبيرة؛ أي “تباطؤ أرباح” أو نتائج أقل من المتوقع في شركات قيادية يضغط على المؤشر سريعًا، لأن الوزن النسبي يضخم التأثير.

خامسًا: التقييمات بعد 2023–2024 كانت تحتاج “تنفيس”

بعد موجات صعود سابقة، جزء من 2025 كان ببساطة إعادة تسعير:

السوق يقول: “أعطني نمو أرباح حقيقي يبرر التقييم”. وإذا النمو جاء أقل، يحصل جني أرباح.

سادسًا: حركة المستثمر الأجنبي كانت انتقائية

الأموال العالمية في 2025 كانت تتحرك بذكاء (وأحيانًا بوقاحة 😄): تذهب حيث توجد قصة نمو واضحة وزخم.

رويترز تلخص المشهد بنهاية العام: مؤشر السعودية هبط قرابة 13% في 2025 ضمن أداء خليجي متباين.

سابعًا: الجغرافيا السياسية تضيف “خصم مخاطرة”

حتى لو لم يحدث تأثير مباشر على أرباح الشركات فورًا، التوترات ترفع “علاوة المخاطر” وتدفع المستثمر الفرد والمؤسسي لتخفيف الانكشاف.

ثامنًا: وزن أرامكو… يحمي أحيانًا ويخنق أحيانًا

عندما يكون سهم ضخم الوزن ضعيفًا أو غير قادر على التعويض، المؤشر يصير مثل سفينة بمحرك واحد.

وبحسب رويترز، أرامكو تراجعت بأكثر من 15% في 2025 (أسوأ عام لها منذ إدراجها 2019)، وهذا يشرح لماذا “الثقل” ما كان داعمًا كفاية.

تاسعًا: مشاريع رؤية 2030… السوق يكره الضبابية

أي تأخير/إعادة جدولة—even لو مؤقت—يخلق سؤالًا عند المستثمر: “متى تنعكس المشاريع على الأرباح فعليًا؟”

السوق لا يحب الوعود، يحب التدفقات النقدية.

عاشرًا: تدوير عالمي نحو أسواق أخرى

في 2025، كثير من الأسواق العالمية حققت مكاسب قوية (مثال: FTSE 100 +21.5% في 2025).

هذا يخلق مقارنة نفسية: “ليش أبقى في سوق متباطئ بينما أسواق أخرى تطير؟” — وهنا يحصل سحب سيولة.

2) إلى أي مدى ساهمت الفائدة وضعف السيولة؟

بصراحة: هذان العاملان كانوا “الضغط التشغيلي الرئيسي” طوال 2025.

الفائدة المرتفعة رفعت “تكلفة الفرصة البديلة”: المستثمر يحصل على عائد شبه مضمون، فيقل اندفاعه للمخاطرة في الأسهم.

السيولة الضعيفة جعلت موجات البيع “أكثر تأثيرًا” لأن عمق السوق أقل، وهذا واضح في الانزلاقات الحادة خلال فترات 2025.

إذا تبغى تشبيه سريع:

الفائدة = فرامل مشدودة، السيولة الضعيفة = طريق زلق… جرّب تسوق بهذي الظروف وشوف 😄

3) هل هو تصحيح مؤقت أم تغير هيكلي؟ وأبرز سيناريوهات 2026

الأقرب: مزيج الاثنين. كـ “تصحيح مؤقت”

جزء معتبر كان إعادة تسعير بعد صعود سابق، + ضغط فائدة ونفط وتقلب عالمي.

كـ “تغير هيكلي” المستثمرون صاروا يطلبون نمو أرباح حقيقي (خصوصًا في القطاعات المرتبطة بتحول الاقتصاد)،

والسوق صار أكثر حساسية لتدفقات السيولة العالمية وتقلبات الاقتصاد الكلي.

3 سيناريوهات عملية لـ 2026

1) السيناريو الأساسي: تعافٍ تدريجي

تحسن مزاج السيولة مع توقعات تخفيف السياسة النقدية عالميًا + استقرار النفط نسبيًا. (رويتز تتحدث عن أن كثيرًا من التوقعات ترى استمرار فائض المعروض مع احتمالات تعافٍ محدود).

2) السيناريو المتفائل: ارتداد قوي

محفزات أرباح + عودة تدفقات أجنبية + نجاح إدراجات/قطاعات نمو… بشرط أن تكون “الأرقام” أفضل من “العناوين”.

3) السيناريو المتشائم: استمرار ضغط

استمرار ضعف النفط أو تأجيل خفض الفائدة أو تصاعد توتر جيوسياسي = إبقاء علاوة المخاطر مرتفعة.

2025 بالأرقام التي تهم المستثمر الفرد

أعلى مستوى خلال 2025: 12,536 نقطة (29 يناير).

أدنى مستوى خلال 2025: 10,367 نقطة (15 سبتمبر).

أدنى إغلاق خلال 2025 (حسب نفس المتابعة): 10,427 نقطة (15 سبتمبر).

إغلاق نهاية السنة: 10,491 نقطة (31 ديسمبر 2025).

أين “نقطة العمى” الشائعة عند المستثمرين؟

إذا ربطت كل شيء بالنفط فقط… أنت تبسّط السوق زيادة عن اللازم.

2025 كان درسًا بأن السيولة + الفائدة + الأرباح قد تكون أحيانًا أهم من النفط في تحريك المؤشر على المدى المتوسط. النفط مؤثر، نعم—لكن ليس “ريموت كنترول” وحيد.

كيف تتعامل كمستثمر في #سوق_الاسهم_السعودي؟

بدل سؤال “هل بيرتفع؟” اسأل “كيف أكون جاهزًا لأي سيناريو؟”:

قسّم محفظتك: جزء دفاعي (عائد/توزيعات/صكوك) + جزء نمو انتقائي.

لا تطارد القصص: طارد الأرباح والتدفقات النقدية والتقييم.

أدر المخاطر بصرامة: وقف خسارة/حجم مركز/تنويع… لأن السوق في بيئة سيولة ضعيفة يعاقب الخطأ بسرعة.