ملخص

قصته ألهمت الشخصية الرئيسية “Larry Livingston” في كتاب Reminiscences of a Stock Operator

جيسي لورستون ليفرمور (1877–1940) واحد من أشهر المضاربين في تاريخ وول ستريت، ويُنظر إليه كرمز مبكر لمدرسة قراءة حركة السعر/التايب (Tape Reading) والتداول مع الاتجاه—مع حقيقة “غير مريحة” لازم تتقال بصراحة: حقق ثروات ضخمة أكثر من مرة… وخسرها أكثر من مرة أيضًا.

بدأ عمليًا كـ موظف لوحة أسعار (board boy) يكتب الأسعار القادمة من شريط الأسعار (ticker tape)، ومن هنا تكوّنت لديه مهارة ملاحظة الأنماط السلوكية للسوق.

لماذا يجب ان تعرف جيسي؟

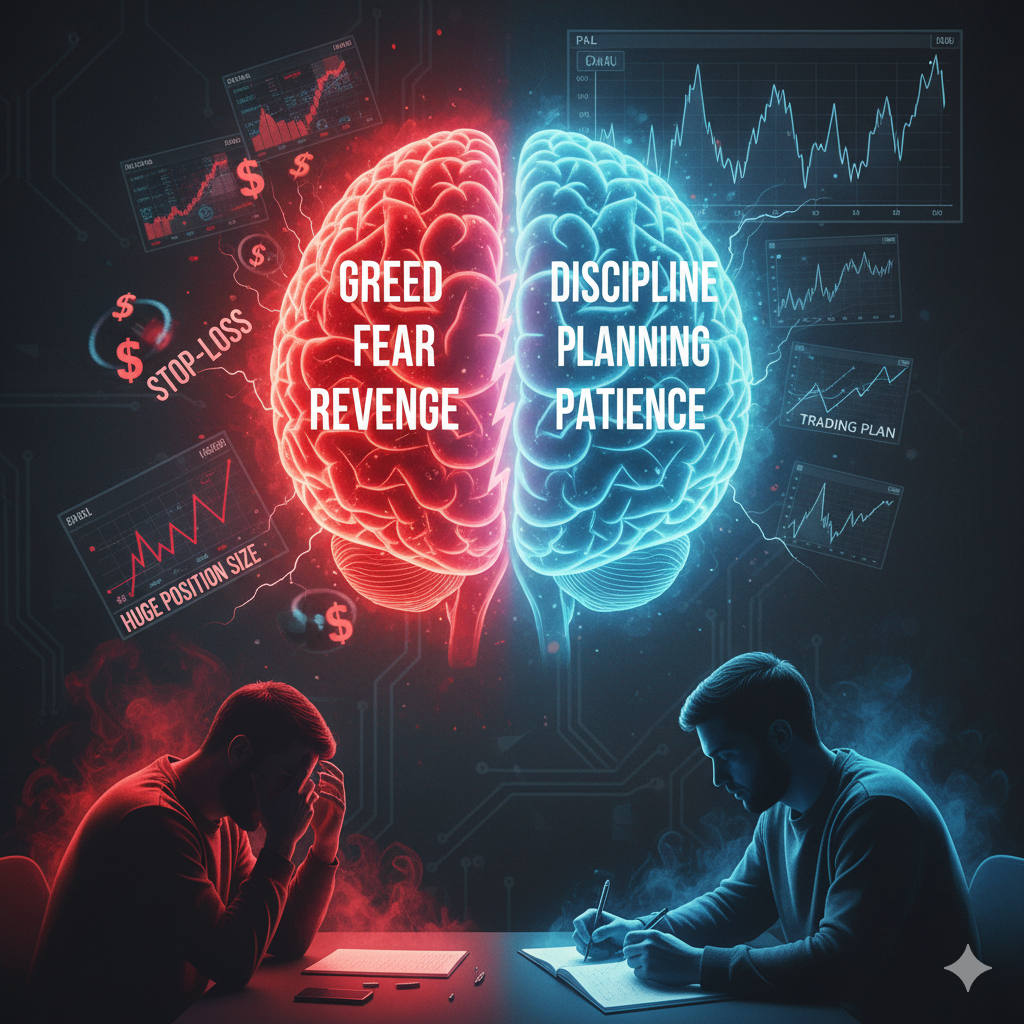

* لأنه يجسّد معادلة السوق الواقعية: Edge + Discipline + Risk Governance… وأي عنصر يسقط، المحصلة قد تكون كارثية.

* وهو مثال ممتاز لتحذير مهم للطلاب: لا تقدّس الأسطورة—خُذ “النظام” واترك “الدراما”. (السوق يحب يصفّق… ثم يخصم التصفيق من رصيدك).

جملة واحدة تلخّصه:

ليفِرمور يعلّمك أن قراءة السوق مهارة… لكن البقاء في السوق حوكمة مخاطر.