ملخص

جملة واحدة تعكس القصة: قبل ما تشتري سهمًا… اشتري دليلًا.

في مرحلة الـ Bucket Shops، جاءه شخص متحمّس يقول له: “عندي نصيحة قوية على سهم (Burlington)… نضاعف الفلوس بسرعة!”

هو ما اتعاملش مع الموضوع كأنه “فرصة ذهبية”، بل كأنه فرضية تحتاج تحقق. أخرج “دفتره الصغير” (الـ dope book) الذي كان يسجل فيه تحركات الأسعار، وسأل سؤالًا بسيطًا لكنه قاتل:

هل حركة السهم فعلًا تؤكد الكلام؟

إذا الدفتر/السعر يدعم… يدخل.

إذا لا… يترك “النصيحة” تمشي لوحدها.

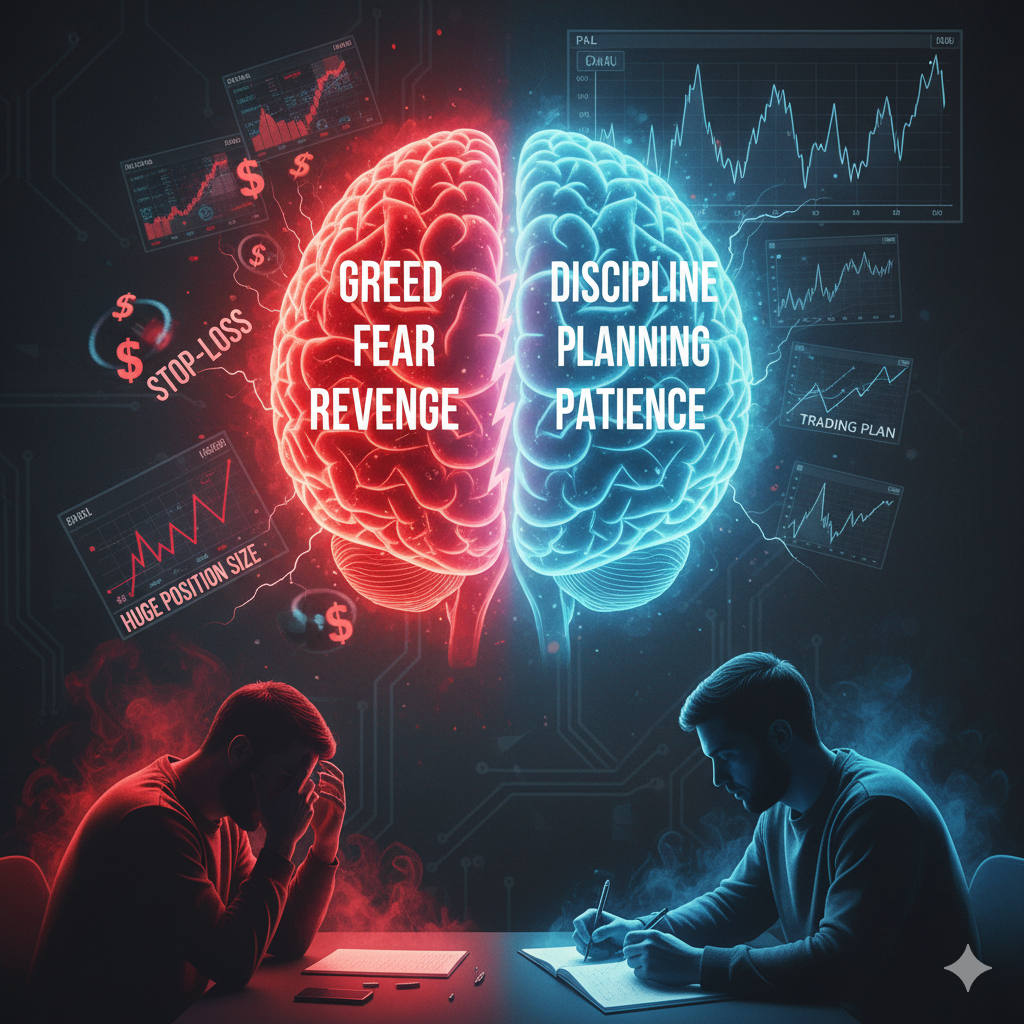

هنا تولد مبدأ جوهري: هو لا يتاجر بالآراء ولا بالتوقعات — يتاجر بنظام (System) قائم على ما يطبعه الشريط (tape) وما يثبته التسجيل.

الدروس للمستثمرين

النصيحة ليست Edge… هي “ضوضاء مدفوعة بالأدرينالين”. الـ Edge الحقيقي = قواعد تحقق + تنفيذ منضبط.

اعمل “دفتر دوب” حديث:

- شروط دخول واضحة (Trigger)

- شروط خروج (Invalidation)

- سبب الصفقة في جملة

- نتيجة الصفقة ودروسها

- لا تقفز لأن “حد واثق”. السوق لا يدفع أرباحًا مقابل الثقة… يدفع مقابل الصحة القابلة للتكرار.