ملخص

الاتجاه هو صديقك في أسواق المال تُعد أسواق المال من أكثر البيئات تعقيدًا وتقلبًا، حيث تتأثر بالعديد من العوامل الاقتصادية والنفسية والسياسية. وفي خضم...

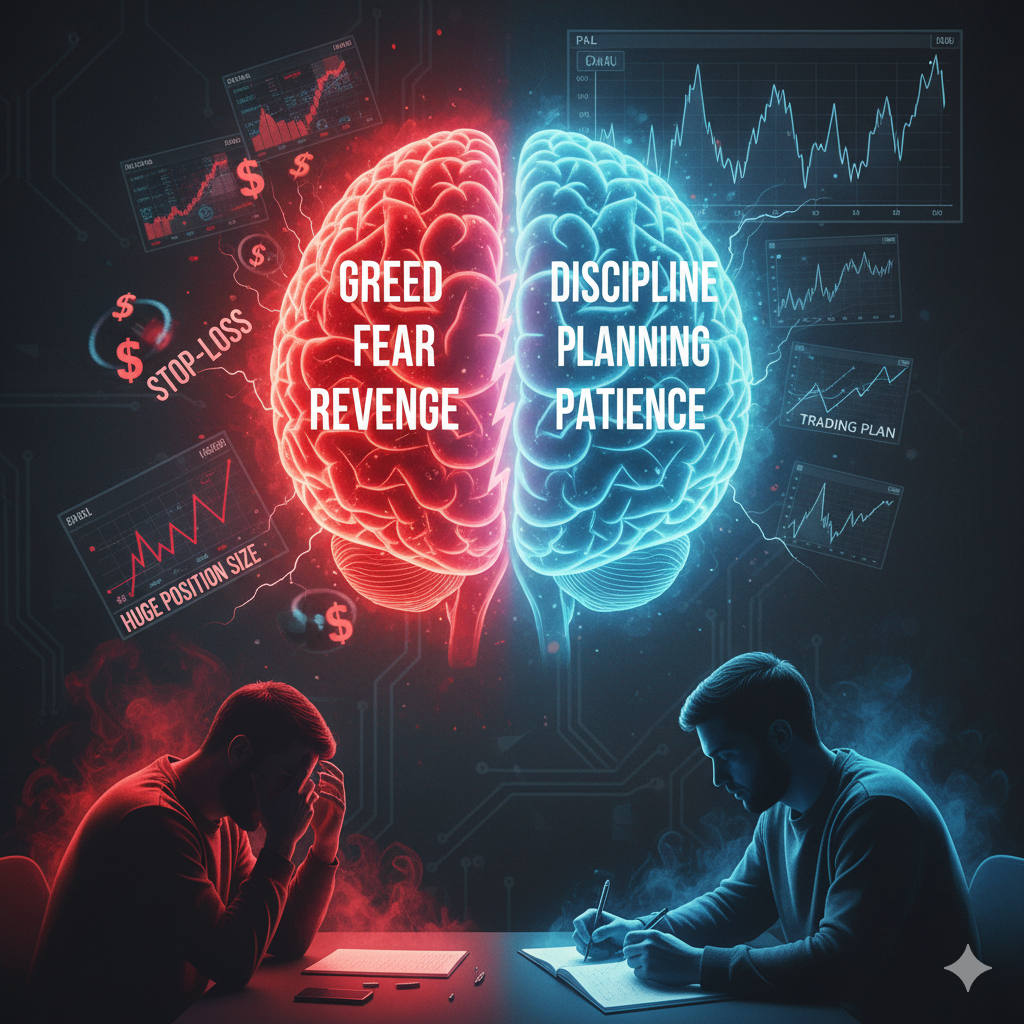

الاتجاه هو صديقك في أسواق المال تُعد أسواق المال من أكثر البيئات تعقيدًا وتقلبًا، حيث تتأثر بالعديد من العوامل الاقتصادية والنفسية والسياسية. وفي خضم هذا التعقيد، ظهرت قاعدة ذهبية يتفق عليها معظم المتداولين المحترفين، وهي: “الاتجاه هو صديقك”. هذه العبارة البسيطة تحمل في طياتها حكمة عميقة يمكن أن تصنع الفارق بين النجاح والفشل في عالم التداول. لماذا يُعتبر الاتجاه صديقك؟ لأن التداول مع الاتجاه يعني السير مع قوة السوق وليس ضدها. فعندما يتماشى قرار المتداول مع الحركة العامة للسوق، فإنه يستفيد من الزخم القائم، مما يزيد من احتمالية نجاح الصفقة. أما التداول عكس الاتجاه، فيشبه السباحة عكس التيار؛ قد يحقق نجاحًا مؤقتًا، لكنه غالبًا ما يكون مصحوبًا بمخاطر أعلى وخسائر أكبر. الجانب النفسي للاتجاه يلعب العامل النفسي دورًا محوريًا في قرارات المتداولين. فكثيرًا ما تدفع العاطفة، مثل الخوف أو الطمع، بعض المتداولين إلى اتخاذ قرارات متسرعة، كالدخول في صفقات عكس حركة السوق على أمل تحقيق أرباح سريعة. الالتزام بالاتجاه يساعد على ضبط النفس، ويمنح المتداول قدرًا أكبر من الانضباط والثقة في قراراته. متى لا يكون الاتجاه صديقك؟ على الرغم من أهمية الاتجاه، إلا أنه ليس ضمانًا دائمًا للنجاح. فقد تتغير ظروف السوق فجأة نتيجة أخبار اقتصادية أو أحداث سياسية غير متوقعة، مما يؤدي إلى انعكاس الحركة. لذلك، من الضروري أن يكون المتداول واعيًا للمخاطر، وأن يعتمد على خطة واضحة وإدارة سليمة لرأس المال لحماية نفسه من التقلبات المفاجئة. خاتمة في الختام، تُعد مقولة “الاتجاه هو صديقك” من أهم المبادئ التي يجب أن يستوعبها كل من يعمل في أسواق المال. فالتداول بانسجام مع حركة السوق العامة يقلل من القرارات العشوائية ويزيد من فرص الاستمرارية والنجاح. ومع الالتزام بالانضباط وإدارة المخاطر، يمكن لهذا المبدأ أن يكون ركيزة أساسية في بناء تجربة تداول ناجح