Summary

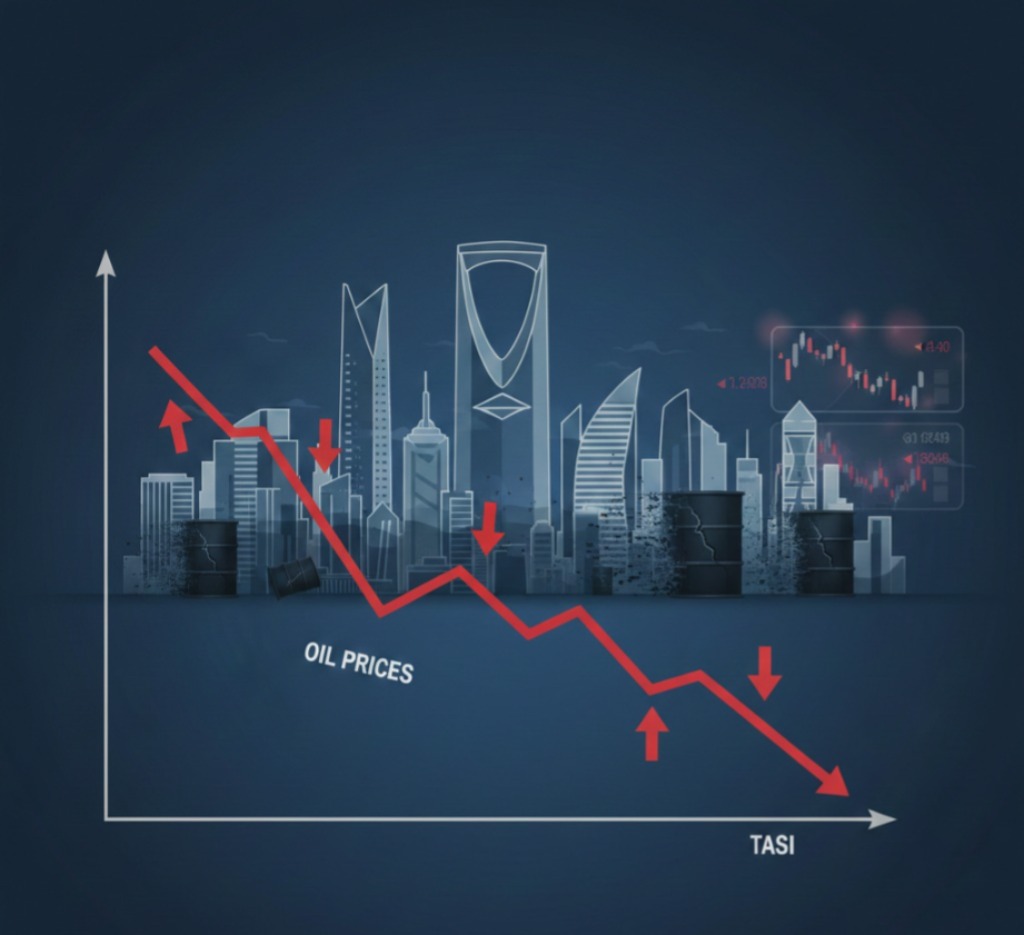

The Saudi main index (TASI) concluded today's session, Thursday, February 5, 2026, with a 1.34% decline, closing at 11,188.73 points (down by 152.54 points). The session witnessed active liquidity reaching SAR 5.5 billion, with a clear divergence in the performance of leading and mid-cap stocks.

📊 Investment Analysis Today's market performance reflects intense profit-taking ahead of the weekend, leading to the breach of key psychological support levels. The current impact is a liquidity outflow from leading sectors; however, some growth stocks like "Fish Fish" and "Malan" showed great resilience and achieved strong gains. Technically, the index's stability above the 11,100 levels next week will be crucial in determining the future path.

🎯 Investor Actions

- Speculators: Focus on high-momentum stocks that defied the market trend today, such as "Fish Fish," while strictly adhering to stop-loss orders to manage early-week volatility.

- Medium-term Investors: It is advisable to wait for the general index to stabilize and confirm support levels before increasing positions in stocks that experienced sharp declines.

- Long-term Investors: It is recommended to hold investment positions in high-yield companies, as the current volatility presents an opportunity to strengthen portfolios at attractive prices.