Summary

There is significant interest in the energy and petrochemicals sector, especially with global news such as the potential issuance of U.S. licenses for oil production in Venezuela and statements from Aramco's CEO regarding oil supply forecasts. These factors directly impact major companies like "Aramco" and "SABIC."

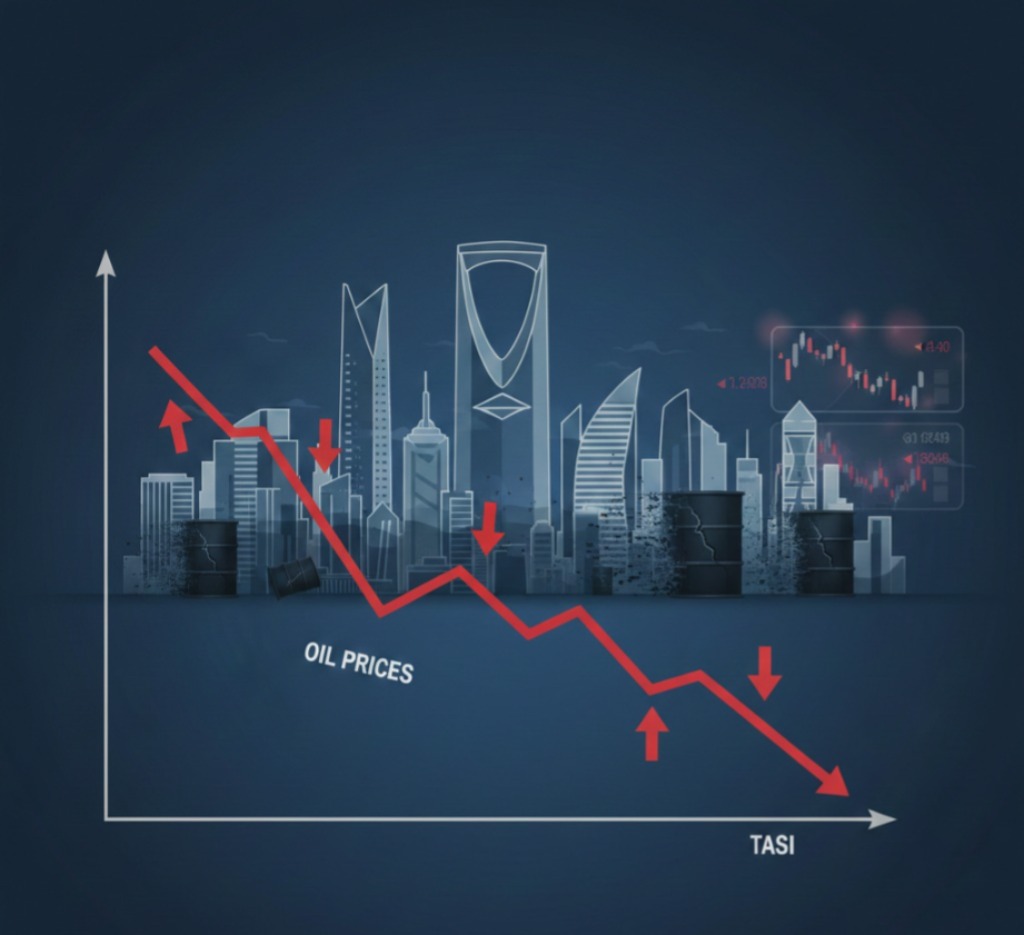

Investment Analysis: Any changes in oil prices or international energy policies will have a direct and strong impact on the performance of this vital sector's stocks in the Saudi market. Stability in oil prices supports the profits of these companies, while volatility increases uncertainty.- What Are Individual Investors Doing?

- Traders (Short-Term): They trade on daily oil news, capitalizing on the resulting price fluctuations.

- Medium-Term Investors: They monitor oil price trends over the coming weeks and months to build their positions in petrochemical stocks.

- Long-Term Investors: They invest in companies with low production costs and strong management that can withstand long-term oil price volatility.