ملخص

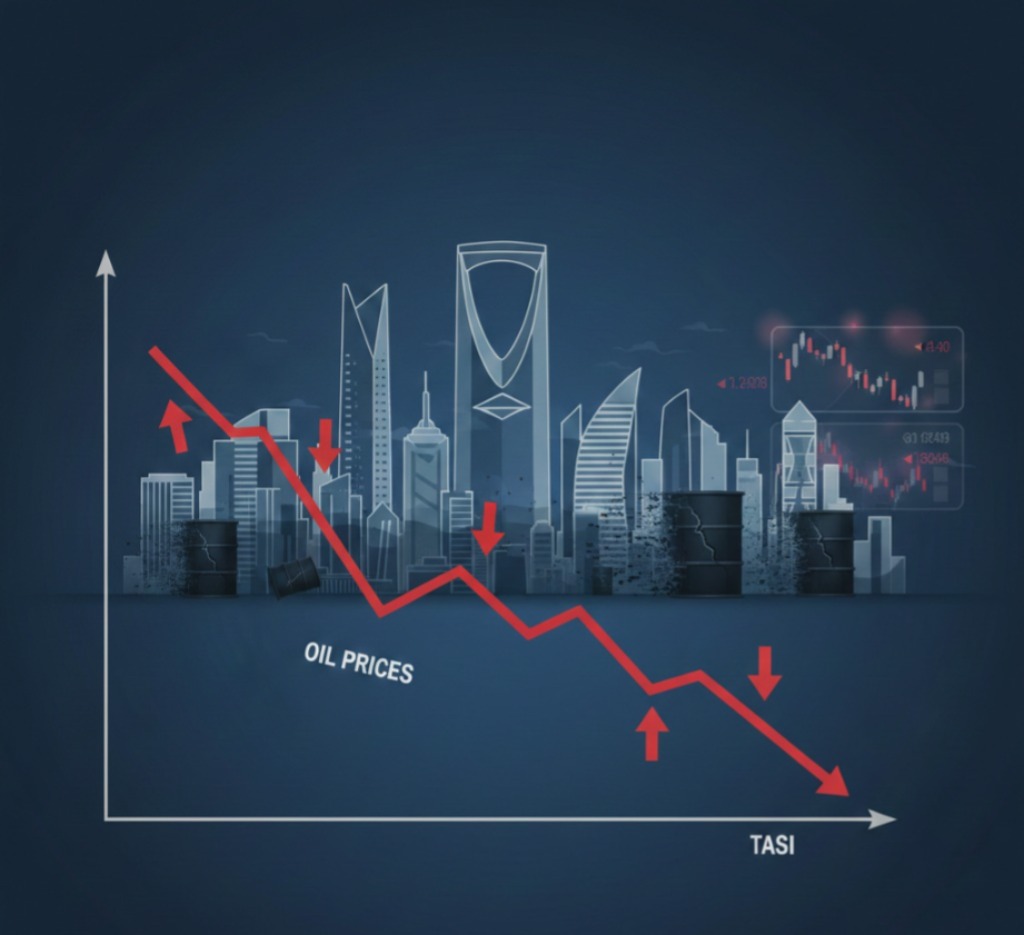

أنهى سوق الأسهم السعودي “تاسي” جلسة اليوم الاثنين بالتراجع بنسبة 0.37% ليغلق عند 10,325.20 نقطة، مع تباين أداء القطاعات وصعود بعض الأسهم القيادية مقابل ضغط قطاع الطاقة والاتصالات، كما ارتفعت قيمة التداولات مقارنة بجلسة أمس.

📊 التحليل الاستثماري

أداء السوق السعودي اليوم يعكس حالة عدم وضوح الاتجاه وسط استمرار اضطراب الزخم بعد موجات التراجع الأخيرة. قيمة التداول ارتفعت، لكن السيولة لم تترجم إلى تحرك صاعد واسع، ما يشير إلى أن المستثمرين لا يزالون يختبرون مستويات الأسعار الحالية قبل اتخاذ قرارات حاسمة.

الملفت اليوم هو التباين القطاعي:

أسهم قوية مثل حديد الرياض وصدق واليمامة للحديد ارتفعت، ما يدل على أن بعض الشركات قادرة على امتصاص الضغط. Arab News

في المقابل، قطاعات مثل الطاقة والاتصالات ضغطت على المؤشر العام، ما يعكس ضعف الدفع الجماعي للصعود. Mubasher

السوق لا يزال يتحرك في نمط عرضي؛

التحوّل الحقيقي يتطلّب استمرار السيولة أو أخبار مؤثرة تُعيد توجيه المستثمرين نحو اتجاه صاعد أو هابط واضح.

🎯 ماذا يفعل المستثمرون الأفراد؟

المضاربون: تجنّب الدخول مع غياب الاتجاه الواضح، وركّز فقط على الأسهم اللي تعطي إشارات مؤكدة.

متوسطي الأجل: راقب السيولة وقيادة القطاعات قبل أي توسّع في المراكز.

طويلي الأجل: حافظ على المراكز الأساسية وتجاهل الضجيج قصير الأجل.