ملخص

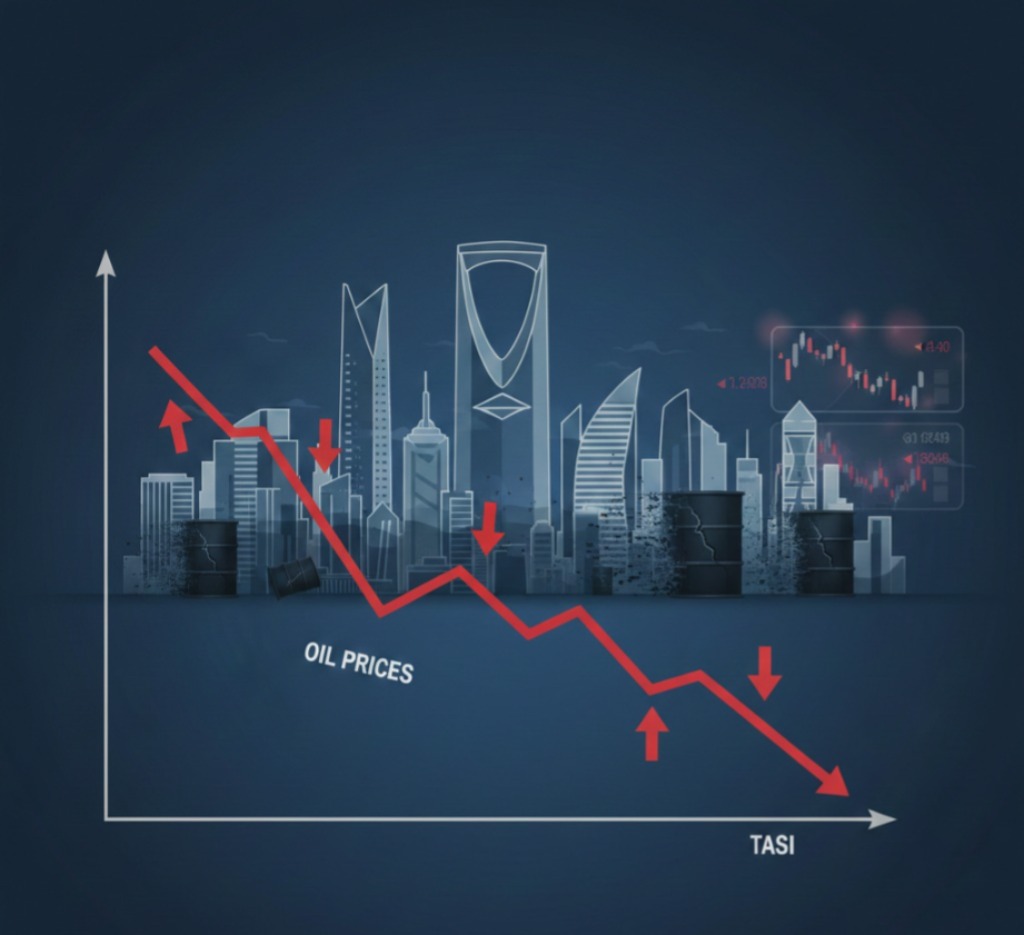

تشهد جلسة اليوم تباينًا في أداء قطاعات السوق السعودي، حيث تحافظ بعض القطاعات القيادية على استقرار نسبي، بينما تتحرك قطاعات أخرى بشكل محدود، في ظل استمرار التداولات الانتقائية وغياب زخم جماعي واضح.

📊 التحليل الاستثماري

التباين القطاعي الحالي يعكس أن المستثمرين لا يتعاملون مع السوق ككتلة واحدة، بل يركزون على القطاعات والأسهم ذات الرؤية الأوضح.

هذا السلوك طبيعي في الفترات التي تسبق:

وضوح الاتجاه العام

أو ظهور محفز اقتصادي أو نتائج شركات

غياب التوافق بين القطاعات يعني:

صعوبة تكوين اتجاه صاعد قوي

وفي نفس الوقت، انخفاض احتمالات الهبوط الحاد

🎯 ماذا يفعل المستثمرون الأفراد؟

المضاربون:

التركيز على القطاعات النشطة فقط، وتجنب التشتت بين أسهم ضعيفة الحركة.

متوسطي الأجل:

راقب أي قطاع يظهر تحسّنًا متواصلًا في السيولة.

طويلي الأجل:

التباين الحالي لا يغير الصورة الاستثمارية طويلة المدى.