ملخص

أغلب المتداولين يصابون بالارتباك بعد عدة خسائر متتالية، فيبدأ الشك يتسرب إلى الخطة التي قضوا شهورًا في إعدادها. لكن الحقيقة أن الثقة ليست نتيجة الصفقات

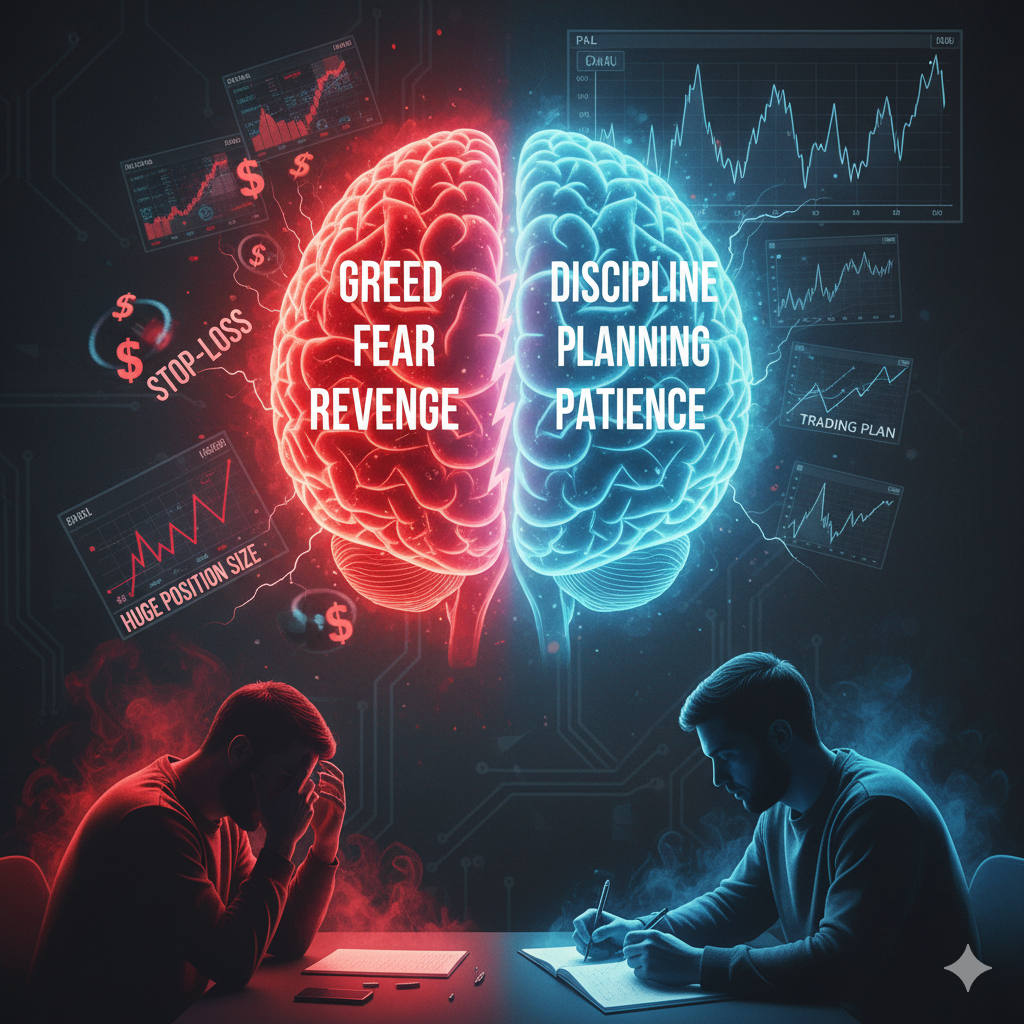

الثقة في خطة التداول ليست رفاهية نفسية، بل شرط أساسي للاستمرارية. المتداول الذي يفتقر للثقة يتنقل بين استراتيجيات متعددة، ويستسلم للانفعالات، وينتهي به الحال بخسائر متكررة. لكن الثقة ليست مجرد شعور لحظي، بل عملية عقلية ومنهجية تُبنى عبر التجربة، الاختبار، والانضباط.

1. مفهوم الثقة في التداول الثقة بالنفس: الإيمان بقدرتك على اتخاذ القرار حتى في بيئة ضبابية. الثقة بالخطة: القبول بأن الخسائر جزء طبيعي من أي نظام، وعدم التشكيك في صلاحية الخطة مع كل تراجع بسيط. الثقة بالعملية: إدراك أن التداول لعبة احتمالات، وليست لعبة يقين.

2. العوائق أمام بناء الثقة الخسائر المتكررة: تصيب المتداول بالارتباك والشك. المقارنات الاجتماعية: متابعة نجاح الآخرين على وسائل التواصل تعزز الشعور بالفشل. غياب الخبرة: الدخول المبكر في السوق بدون تدريب كافٍ يجعل الثقة هشة.

3. الأسس العلمية لبناء الثقة الاختبار التاريخي (Backtesting): تجربة الاستراتيجية على بيانات سابقة تعطيك دليلًا إحصائيًا على صلاحيتها. التجارب الوهمية (Paper Trading): تعطي مساحة للتدريب بدون مخاطر مالية. التكرار والانضباط: الممارسة المنهجية تعيد برمجة الدماغ لقبول القرارات الباردة بعيدًا عن الانفعال.

4. منهجيات نفسية لتعزيز الثقة العقلية الاحتمالية: التفكير بلغة "إذا حدث كذا → فإني سأفعل كذا"، بدلًا من التفكير الحتمي. التصور الذهني: ممارسة سيناريوهات الدخول والخروج ذهنيًا قبل السوق. التعزيز الإيجابي: الاحتفال بالالتزام بالخطة، حتى لو كانت النتيجة خسارة مالية.

5. العلاقة بين الثقة والنجاح الطويل المدى الثقة لا تلغي الخسائر، لكنها تمنعك من الوقوع في دائرة "تغيير الخطة مع كل خسارة". وهذا هو الفارق بين المحترف والهواة: الأول يخسر بنفس الثقة التي يربح بها.

🔹 الخلاصة: الثقة ليست هدية تأتي من الخارج، بل مهارة تُبنى داخليًا. كلما اختبرت خطتك وتدربت على الالتزام بها، أصبحت أكثر ثقة وأكثر قدرة على مواجهة السوق بقوة.