ملخص

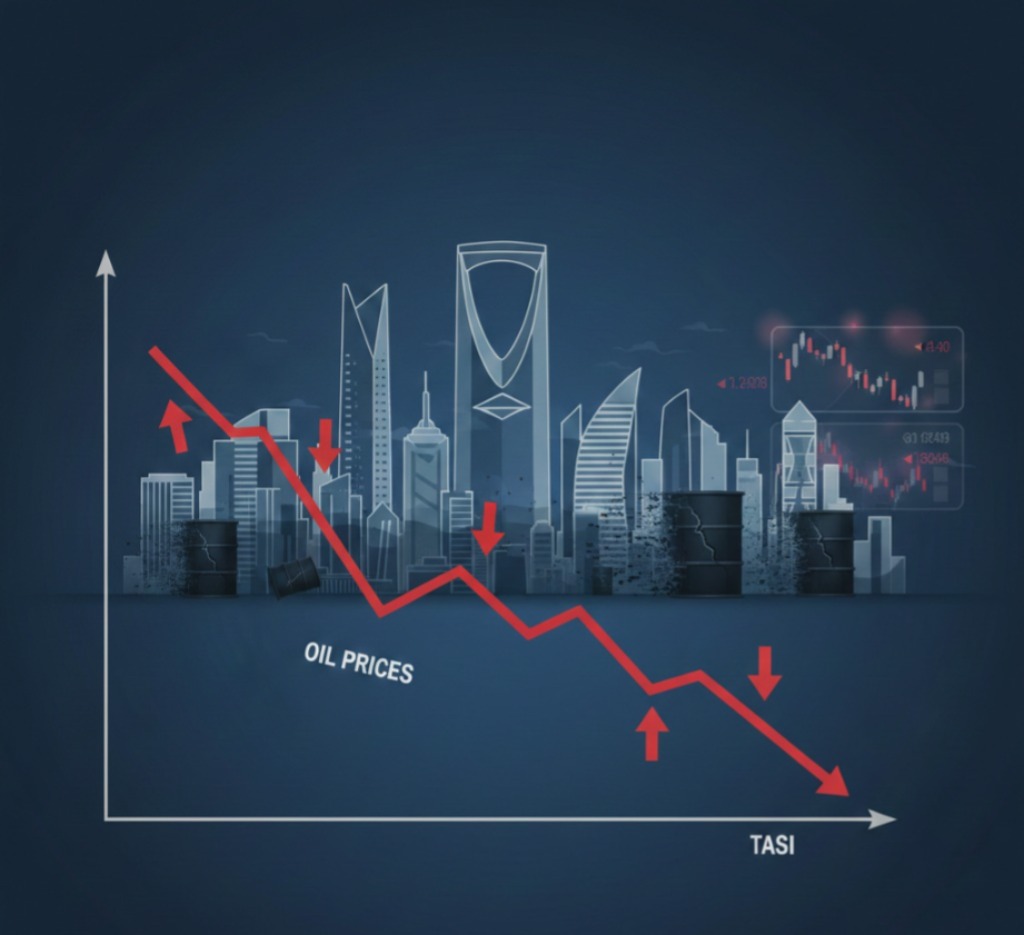

تراجعت أسواق الخليج خلال تداولات اليوم مع استمرار ضعف أسعار النفط، حيث قاد السوق السعودي موجة الهبوط وسط ضغوط على الأسهم القيادية، في ظل حذر المستثمرين من تراجع شهية المخاطرة عالميًا.

📊 التحليل الاستثماري

العلاقة بين سوق الأسهم السعودي وأسعار النفط ليست خطية، لكنها تصبح أكثر وضوحًا عندما يكون هبوط النفط حادًا أو ممتدًا زمنيًا. في مثل هذه الحالات، لا يكون الأثر ناتجًا عن تراجع أرباح فوري للشركات، بل عن تغير المزاج الاستثماري العام.

ضعف النفط ينعكس على:

توقعات الإنفاق والاستثمار.

شهية الصناديق للمخاطر.

سرعة دوران السيولة داخل السوق.

النتيجة العملية أن السوق يميل إلى سلوك دفاعي، يتمثل في تخفيف المراكز على الأسهم القيادية وتقليل الانكشاف، حتى في الشركات التي تتمتع بأساسيات تشغيلية جيدة. هذا الضغط غالبًا ما يكون مؤقتًا، لكنه قد يستمر طالما بقي النفط تحت الضغط.

🎯 ماذا يفعل المستثمرون الأفراد؟

المضاربون: تعامل مع الجلسة كجلسة “نفط”؛ لا تُعاند الاتجاه وانتظر إشارات استقرار.

متوسطي الأجل: راقب استقرار أسعار النفط قبل زيادة الأوزان أو فتح مراكز جديدة.

طويلي الأجل: لا تخرج من استثمار جيد بسبب ضغط قصير الأجل؛ ركّز على الجودة والتقييم.