ملخص

✔️ التحليل الفني يعتمد على سلوك السعر وليس اسم السوق، لذلك ينطبق على السوق السعودي. ✔️ توافر السيولة، العرض والطلب، والتفاعل النفسي يجعل سوق تداول مناسبًا للتحليل الفني. ✔️ النجاح يتطلب إدارة مخاطر وانضباط، لأن التحليل الفني أداة وليس ضمان ربح.

❌ المقولة دي غير صحيحة علميًا

لأن التحليل الفني لا يعتمد على اسم السوق،

بل يعتمد على سلوك السعر والمتداولين.

---

✅ متى يعمل التحليل الفني؟

التحليل الفني يعمل في أي سوق تتوفر فيه:

1. عرض وطلب

2. سيولة

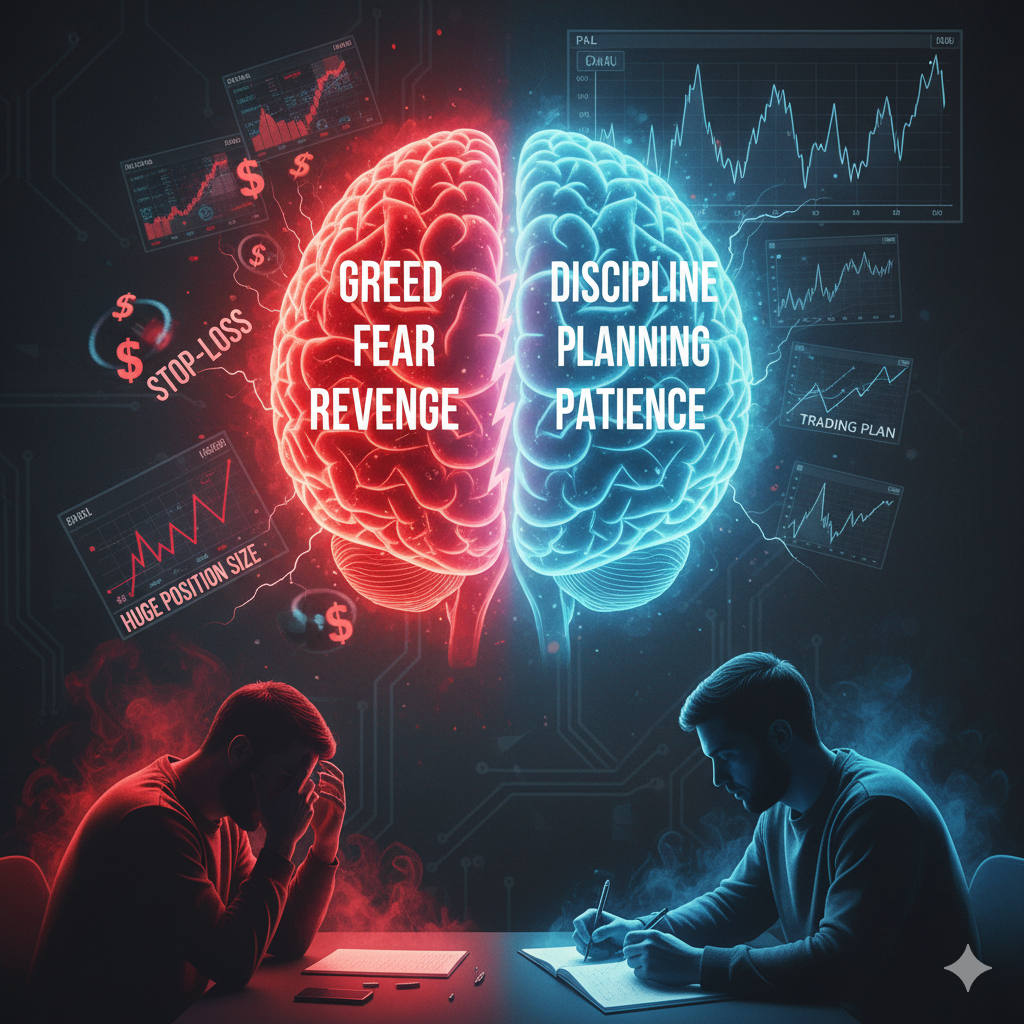

3. تفاعل نفسي بشري (خوف وطمع)

4. بيانات سعرية منتظمة

📌 وكل الشروط دي متوفرة بقوة في السوق السعودي

---

🧠 الدليل العلمي

التحليل الفني مبني على 3 مبادئ أساسية:

السعر يعكس كل المعلومات

التاريخ يعيد نفسه

الاتجاه يستمر حتى يثبت العكس

❗ المبادئ دي تنطبق على السوق السعودي

زيها زي:

السوق الأمريكي

الأوروبي

أي سوق مالي منظم

---

🇸🇦 ليه السوق السعودي تحديدًا مناسب للتحليل الفني؟

سيولة عالية

عدد كبير من المتداولين

مؤسسات وصناديق استثمار

اتجاهات واضحة على كثير من الأسهم

📌 وده بيخلي:

الدعم والمقاومة واضحة

الترندات قابلة للتحليل

النماذج السعرية تتكرر

---

⚠️ إمتى يقل تأثير التحليل الفني؟

وقت الأخبار الجوهرية المفاجئة

في الأسهم قليلة السيولة

عند تجاهل إدارة المخاطر

❌ وده مش عيب في التحليل الفني

ده سوء استخدام

---

✅ الخلاصة

✔️ سوق الأسهم السعودية ينطبق عليها التحليل الفني

✔️ لكن النجاح محتاج:

اختيار سهم مناسب

احترام الفوليوم

إدارة رأس المال

الصبر والانضباط

📌 التحليل الفني أداة

مش ضمان ربح