ملخص

الخسارة جزء من اللعبة. حتى أفضل المتداولين في العالم يخسرون، لكن الفرق هو كيف يتعاملون مع الخسارة. 1. لماذا نخاف من الخسارة؟ برمجة عقلية: الخسارة مر...

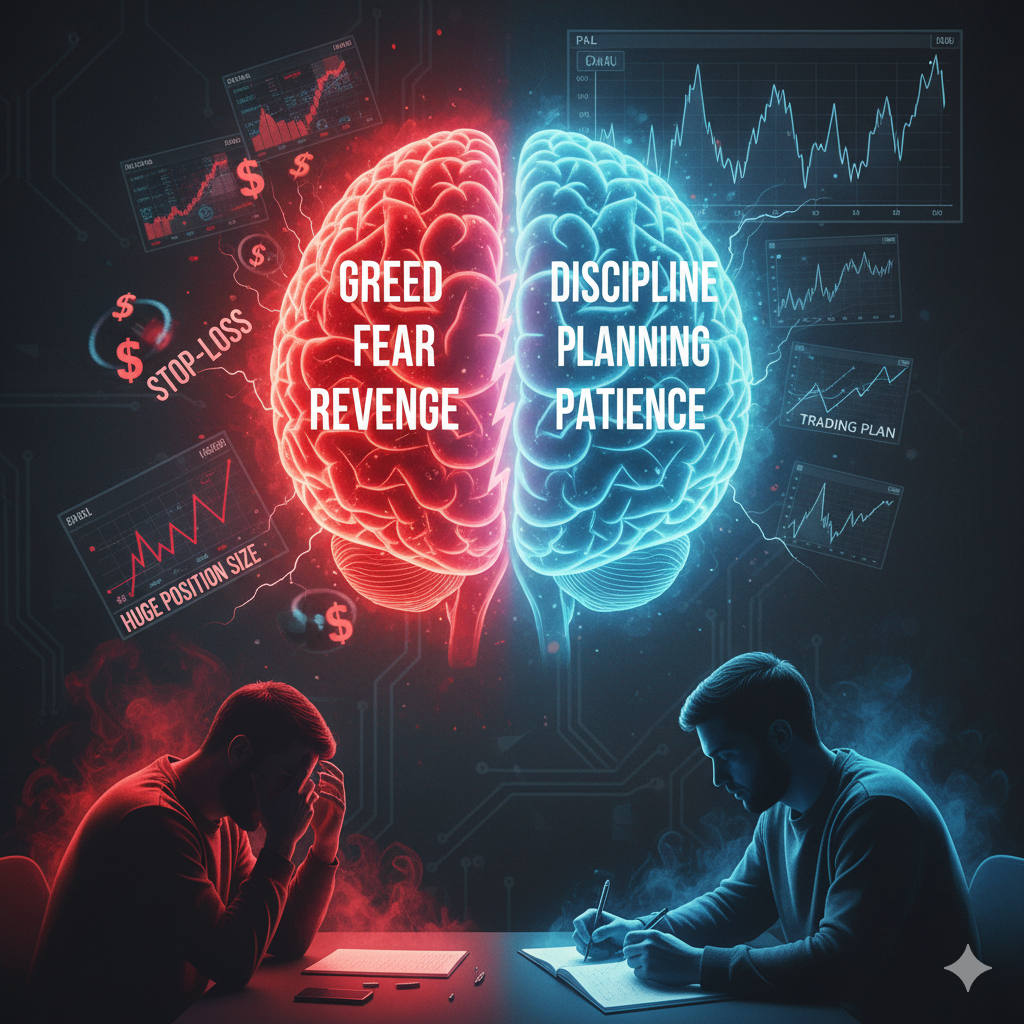

الخسائر أمر حتمي، لكن كيفية التعامل معها تحدد مصير المتداول. الانفعال الزائد يحول خسارة صغيرة إلى كارثة، بينما الهدوء والانضباط يحولها إلى درس تعليمي.

1. سيكولوجية الخسارة ألم الخسارة يعادل ضعف متعة الربح. "الخوف من الندم" يدفع البعض لإغلاق الصفقة بسرعة أو الاحتفاظ بالخاسرة أملًا.

2. الأنماط الشائعة عند مواجهة الخسائر الهروب: التوقف عن التداول فجأة. المطاردة: الدخول بصفقات أكبر لتعويض الخسارة. الإنكار: رفض الاعتراف بالخطأ وتحريك وقف الخسارة للأبعد.

3. استراتيجيات نفسية لإدارة الخسارة إعادة التأطير: اعتبار الخسارة "تكلفة تعليم". الفصل بين الأنا والنتيجة: أنت لست صفقاتك. العقلية الإحصائية: صفقة واحدة لا تعني شيئًا أمام 100 صفقة.

4. أدوات عملية وضع حد أقصى للخسائر اليومية/الأسبوعية. أخذ فترات استراحة بعد سلسلة خسائر. مراجعة الخسائر بهدوء مع تدوين الدروس.

5. الدروس من كبار المستثمرين حتى أساطير مثل وارن بافيت وجيسي ليفرمور مروا بخسائر ضخمة، لكنهم استمروا لأنهم تعاملوا مع الخسارة كجزء طبيعي من العمل.

🔹 الخلاصة: الخسائر ليست نهاية المطاف، بل هي جزء لا يتجزأ من مسيرة أي متداول محترف. السيطرة على الانفعالات هي ما يحدد إن كنت ستستمر أو ستخرج من السوق.