ملخص

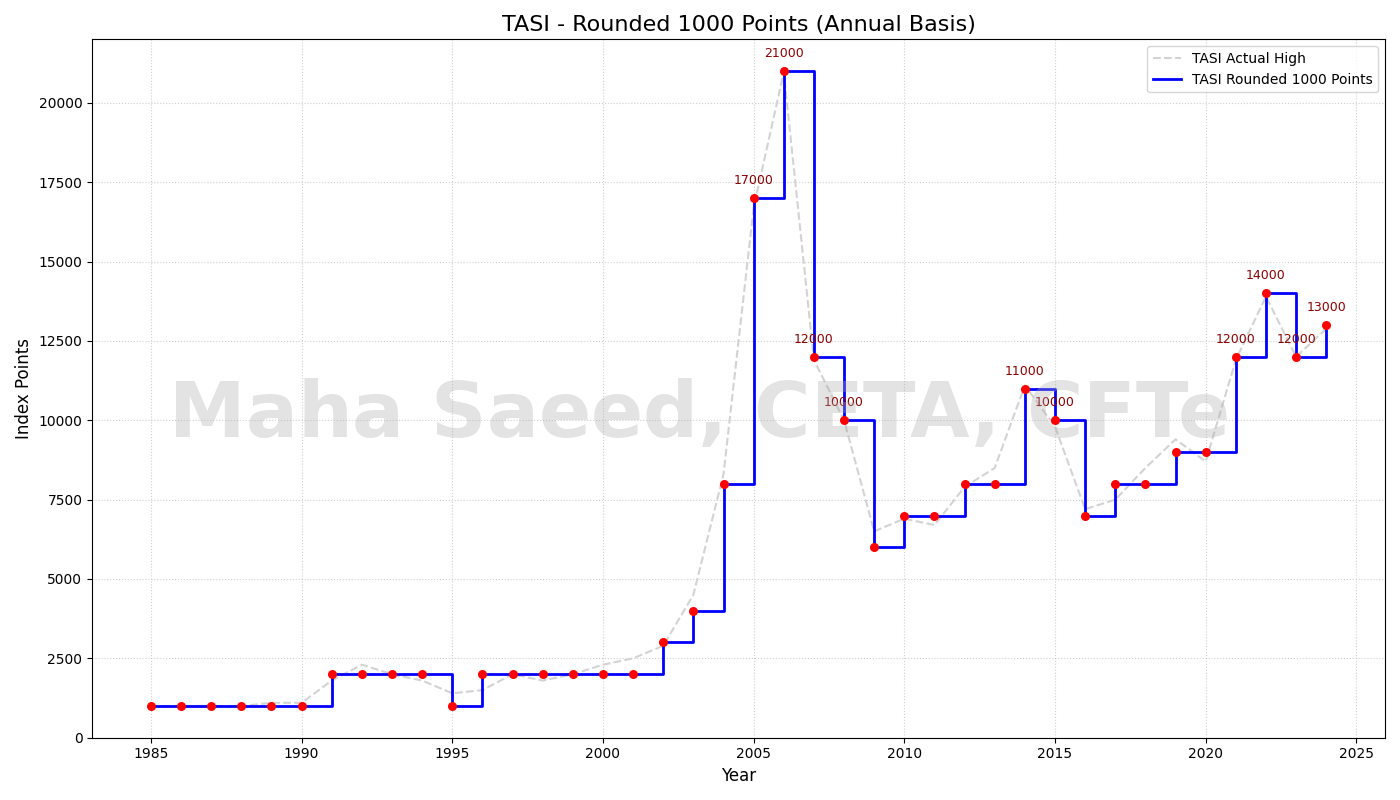

الدراسة توضح إن تاسي يتحرك على مراحل نفسية، وأهم إشاراتها هي الأرقام المقربة مثل: 1,000 – 2,000 – 3,000 – 10,000 – 12,000 – 14,000.

الدراسة توضح إن تاسي يتحرك على مراحل نفسية،

وأهم إشاراتها هي الأرقام المقربة مثل:

1,000 – 2,000 – 3,000 – 10,000 – 12,000 – 14,000.

هالأرقام ما توقف السعر فقط،

لكن تغيّر سلوك ونفسية المستثمرين.

والأهم هنا: الزمن + نسبة الصعود.

⏳ تاريخ تاسي باختصار:

1,000 → 2,000 | +100٪ خلال 6 سنوات

2,000 → 3,000 | +50٪ خلال 11 سنة

(مرحلة بناء بطيئة وطبيعية)

3,000 → 21,000 | أكثر من +600٪ خلال 4 سنوات (2003–2006)

👉 مرحلة نشوة واندفاع عالي

21,000 → 12,000 | -43٪

ثم 15 سنة بدون قمم نفسية جديدة

👉 صدمة وفقدان ثقة

12,000 → 14,000 | +16.7٪ خلال سنة (2021–2022)

👉 عودة زخم لكن بهدوء

🧠 ليه الأرقام المقربة مهمة؟

مناطق شد وجذب (بيع/شراء)

كسر سريع = زخم قوي

انتظار طويل = سوق متردد

تعكس “مزاج السوق”

🎯 الخلاصة:

السوق ما يُقاس بعدد النقاط،

يُقاس بالوقت والنسبة.

صعود سريع جدًا = انتبه

صعود بطيء وثابت = غالبًا صحي

اللي يفهم الزمن + النِّسب + النفسية

يعرف يتعامل مع السوق بدون اندفاع ولا خوف.