Summary

Argaam reports completion of a SAR 1 billion sukuk offering (SAL) and several corporate financing activities, including REIT buybacks and project financing agreements — signaling active capital markets operations.

📊 Investment Analysis

Today’s session highlights a mixed market environment.

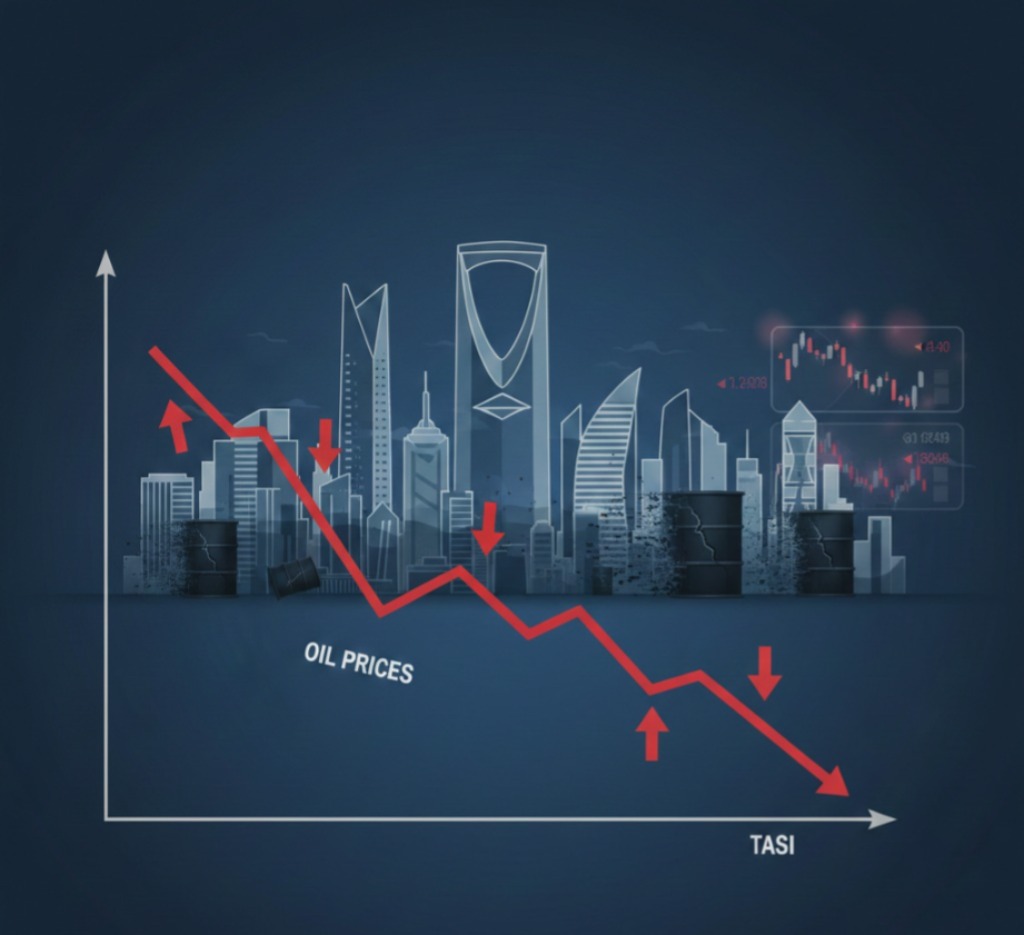

Geopolitical risk pressures broad market sentiment, leading to modest declines in TASI.

Higher oil prices anchor energy stocks, offering defensive strength.

The fact that several stocks hit 52-week highs amid the broader weakness suggests rotational flows into quality names rather than blanket selling. This kind of behavior typically precedes a more definitive market directional shift, which will hinge on:

✔ sustained commodity support (oil)

✔ geopolitical clarity

✔ upcoming corporate earnings resultsؤ.

🎯 What Should Retail Investors Do?

Short-term traders:

Avoid aggressive positions amid geopolitical-driven volatility — focus only on high-liquidity names.

Medium-term investors:

Prefer select quality stocks showing leadership rather than broad exposure.

Long-term investors:

Focus on fundamentals — geopolitical news is typically short-lived and may not alter core thesis.